The cryptocurrency trading landscape is experiencing a profound transformation as artificial intelligence and machine learning technologies reshape how traders analyze markets, predict price movements, and execute strategies. This revolution is fundamentally changing the financial technology sector, with AI-driven systems now processing over 70% of all cryptocurrency trades and managing billions in assets across decentralized finance protocols.

AI system analyzing social media sentiment for crypto trading predictions

How AI Sentiment Analysis is Revolutionizing Bitcoin Trading Strategies

The integration of AI-powered sentiment analysis into cryptocurrency trading represents one of the most significant breakthroughs in predictive market analytics. Traditional technical analysis, while still valuable, is being enhanced and sometimes replaced by sophisticated machine learning algorithms that can process vast amounts of social media data, news sentiment, and market psychology indicators in real-time.

The Shift from Technical to Sentiment-Driven Analysis

Modern AI sentiment analysis systems achieve remarkable accuracy rates in predicting Bitcoin price movements. Research conducted by Georgoula et al. using Support Vector Machine algorithms achieved 89.6% accuracy in predicting Bitcoin price fluctuations through Twitter sentiment analysis. This breakthrough study demonstrated that AI models could identify short-term correlations between positive Twitter sentiment and Bitcoin price movements with unprecedented precision.

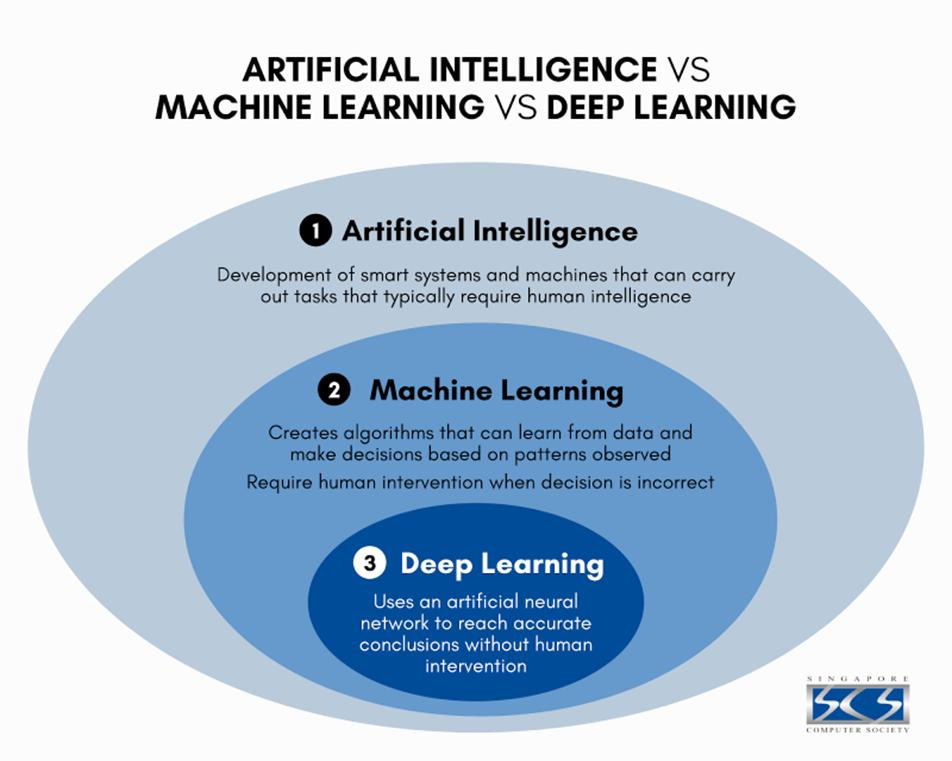

Understanding the relationship between artificial intelligence, machine learning, and deep learning.

The sophistication of these systems extends far beyond simple keyword matching. Advanced models now utilize multiple data sources including Twitter, Reddit, and financial news headlines. A comprehensive study covering the period from 2019-2024 employed both VADER (Valence Aware Dictionary for sEntiment Reasoner) and fine-tuned BERT models to analyze sentiment polarity across major social platforms. The research found that Support Vector Machines slightly outperformed other modeling approaches including Logistic Regression and Random Forest algorithms in predicting Bitcoin market volatility.

Multi-Platform Sentiment Integration

Recent developments in sentiment analysis have moved beyond single-platform approaches to integrate data from multiple sources. Studies demonstrate that combining sentiment signals from different platforms significantly enhances forecasting accuracy. Research shows that integrating TikTok video-based sentiment with Twitter text-based sentiment improves cryptocurrency forecasting accuracy by up to 20%. This multimodal approach reveals that TikTok sentiment particularly influences short-term speculative trends, while Twitter sentiment aligns better with long-term market dynamics.

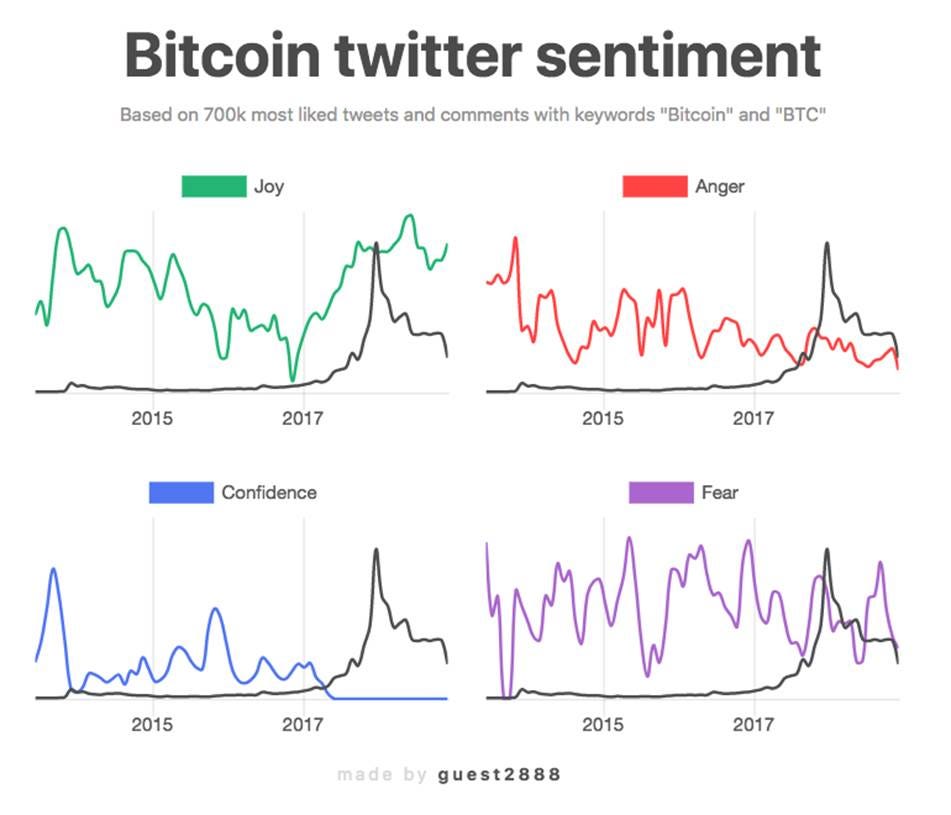

Bitcoin twitter sentiment trends for joy, anger, confidence, and fear from 2013-2018 based on 700k tweets and comments showing relations to Bitcoin price movements.

The predictive power varies significantly across different cryptocurrencies. Twitter sentiment analysis shows particularly strong predictive capabilities for Bitcoin, Bitcoin Cash, and Litecoin. When using a "bullishness ratio" metric, predictive power extends to EOS and TRON as well. These findings suggest that sentiment-driven models work most effectively with established cryptocurrencies that have substantial social media presence and discussion volume.

Real-Time Implementation and Performance

Modern AI sentiment analysis systems operate in real-time, processing over 1 million data points per second. These systems demonstrate significant operational advantages:

· Execution speed: 0.01 seconds versus human reaction time of 0.3 seconds

· Success rates: 82% win rate compared to 43% for manual trading

· Emotional bias elimination: 47% reduction in psychological trading errors

The technology enables cryptocurrency-specific lexicon-based sentiment analysis that goes beyond generic sentiment tools. Platforms can now integrate real-time social media APIs to provide instant readings on public sentiment, enabling traders to make informed decisions based on current market psychology rather than historical indicators.

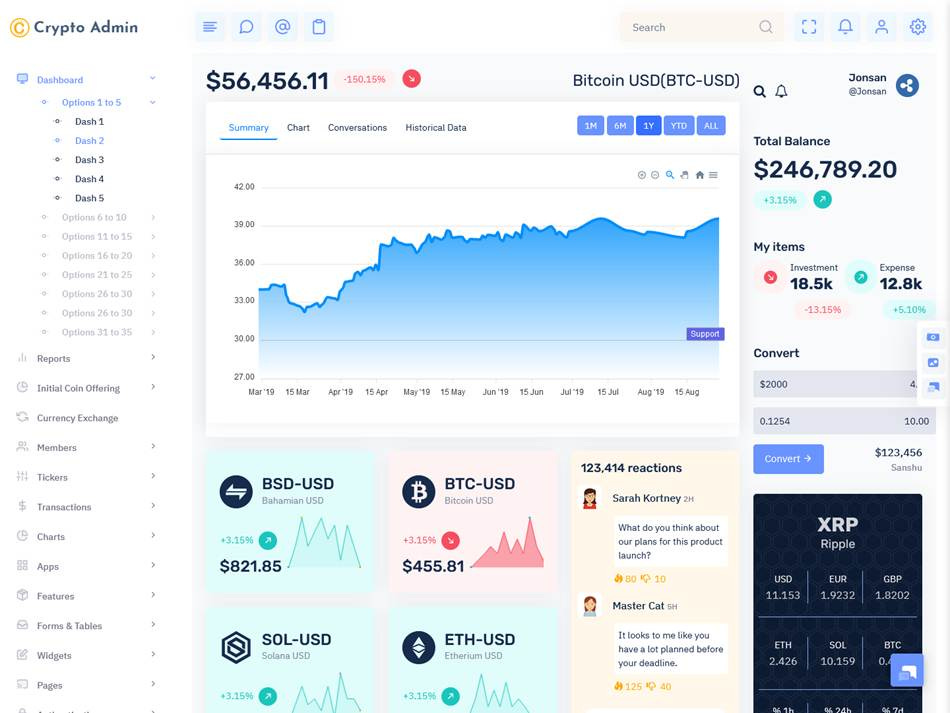

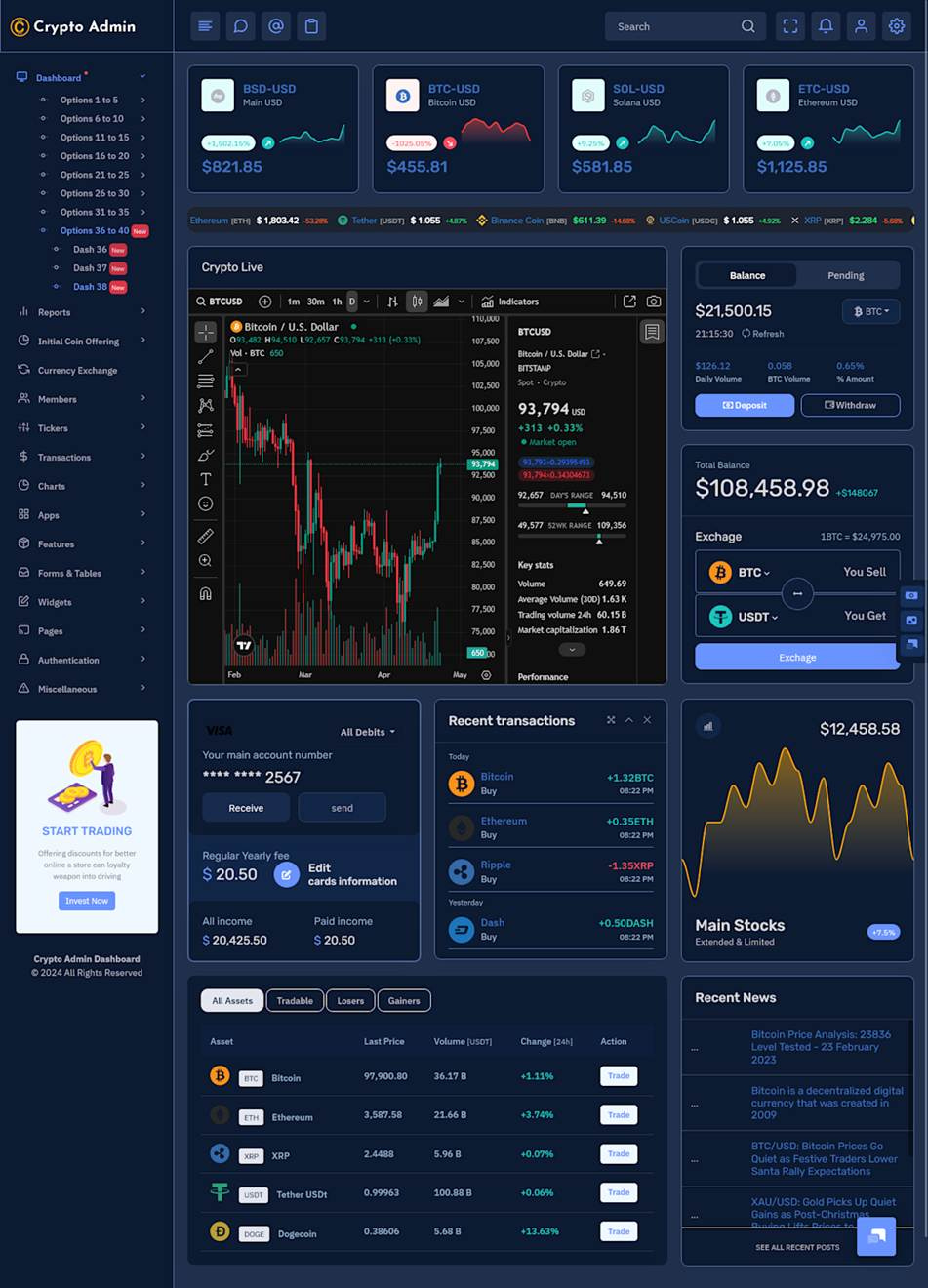

A cryptocurrency dashboard UI showing real-time Bitcoin price charts, portfolio balance, currency conversion tools, and social sentiment feedback.

The Rise of Autonomous Trading Bots in DeFi

Decentralized Finance has become a fertile ground for AI-powered autonomous trading systems. With over $129 billion in Total Value Locked (TVL) across DeFi protocols as of January 2025, representing a 137% year-over-year increase, the ecosystem has reached sufficient scale to support sophisticated automated trading strategies.

Market Making and Liquidity Provisioning

AI-powered market making bots play a crucial role in DeFi ecosystem stability and efficiency. These systems provide continuous liquidity by placing buy and sell orders around current market prices, earning profits from bid-ask spreads while improving market depth. Unlike centralized exchanges, DeFi market making requires interaction with smart contracts and automated market makers (AMMs) rather than traditional order books.

Autonomous trading bot optimizing DeFi liquidity and yield strategies

Modern DeFi trading bots utilize machine learning algorithms that adapt strategies based on real-time market data. The most advanced systems can:

· Analyze cross-protocol opportunities: Scanning 50+ protocols simultaneously to identify optimal yield sources

· Optimize gas fees: Reducing Ethereum transaction costs by 15-40% through intelligent batch processing

· Manage impermanent loss: Using predictive modeling to minimize losses from price divergence in liquidity pools

· Execute arbitrage: Capturing 89% of opportunities across decentralized exchanges versus 12% for manual trading

Yield Farming Optimization

AI-powered yield optimizers represent the next evolution in DeFi automation. These systems continuously analyze market conditions across multiple protocols to maximize returns while managing risk exposure. Yearn Finance, one of the leading platforms, utilizes AI algorithms to optimize yield farming strategies by analyzing market conditions and protocol performance.

A professional cryptocurrency trading dashboard displaying real-time Bitcoin buy/sell orders, price charts, and trade management tools.

The mechanics of AI-driven yield optimization involve several sophisticated processes:

Predictive APY Modeling: Forecasting rate fluctuations before market movements using historical data and liquidity pool trends

Dynamic Risk Assessment: Real-time evaluation of smart contract vulnerabilities and protocol risks using anomaly detection algorithms

Automated Rebalancing: Continuous portfolio adjustment based on changing yield opportunities and risk parameters

Risk Management and Security

AI-driven risk management has become essential for DeFi protocol security. These systems provide real-time threat detection by analyzing on-chain data to identify suspicious patterns and potential security threats. Platforms like Chainalysis and Elliptic leverage AI to provide alerts on suspicious activities, helping DeFi protocols respond quickly to potential threats.

The integration of AI in DeFi risk management addresses several critical areas:

· Smart contract vulnerability assessment: Automated code analysis to identify potential exploits

· Liquidity risk monitoring: Real-time tracking of pool depths and potential bank runs

· Compliance and AML measures: Automated transaction monitoring for regulatory compliance

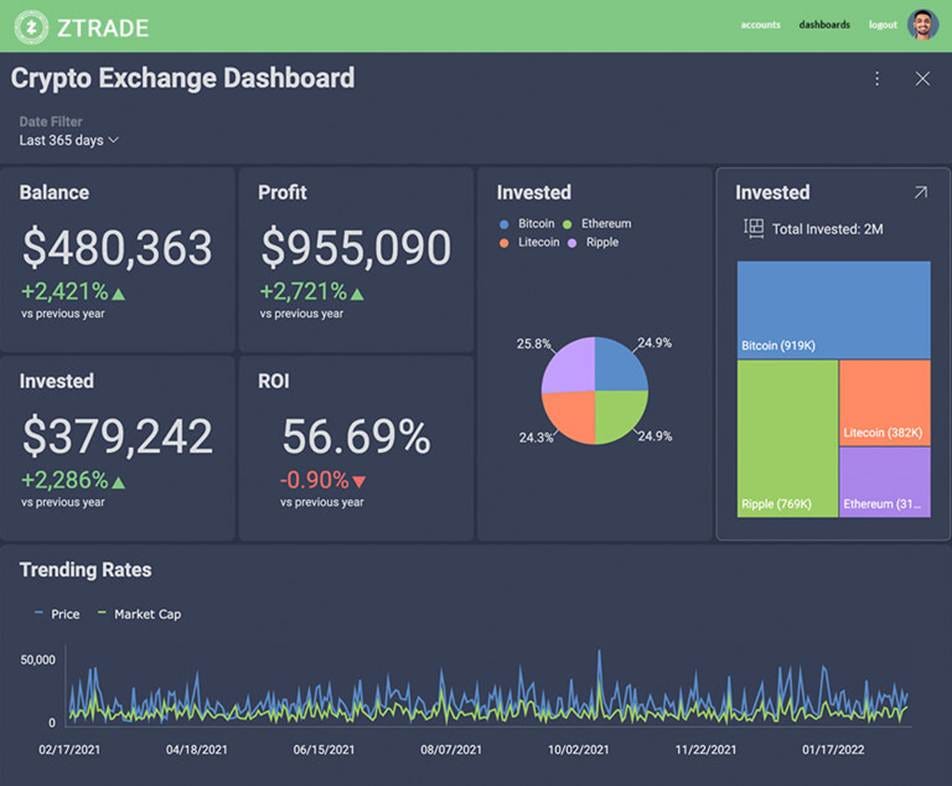

Crypto trading dashboard showing portfolio balance, profit, ROI, and investment distribution across major cryptocurrencies with trending market data over time.

Market Performance and Growth

The DeFi autonomous trading bot market is experiencing explosive growth. The crypto trading bot market, valued at $1.63 billion in 2024, is projected to reach $5.42 billion by 2032, growing at a CAGR of 16.2%. This growth is driven by increasing cryptocurrency adoption, 24/7 market operations, and the sophistication of algorithmic trading strategies.

Performance metrics for leading AI-powered DeFi strategies demonstrate significant advantages:

· Capital efficiency improvements: Up to 300% better volume handling without performance degradation

· Drawdown control: Maximum 7% versus 15% average for manual trading

· Operating cost reduction: 70% lower than human trader management

The ecosystem has evolved to support over 150 protocols individually holding more than $100 million in locked assets. Ethereum continues to dominate with 63% market share ($78.1 billion TVL), while emerging chains like Arbitrum ($10.4 billion) and Optimism ($5.6 billion) are gaining significant traction.

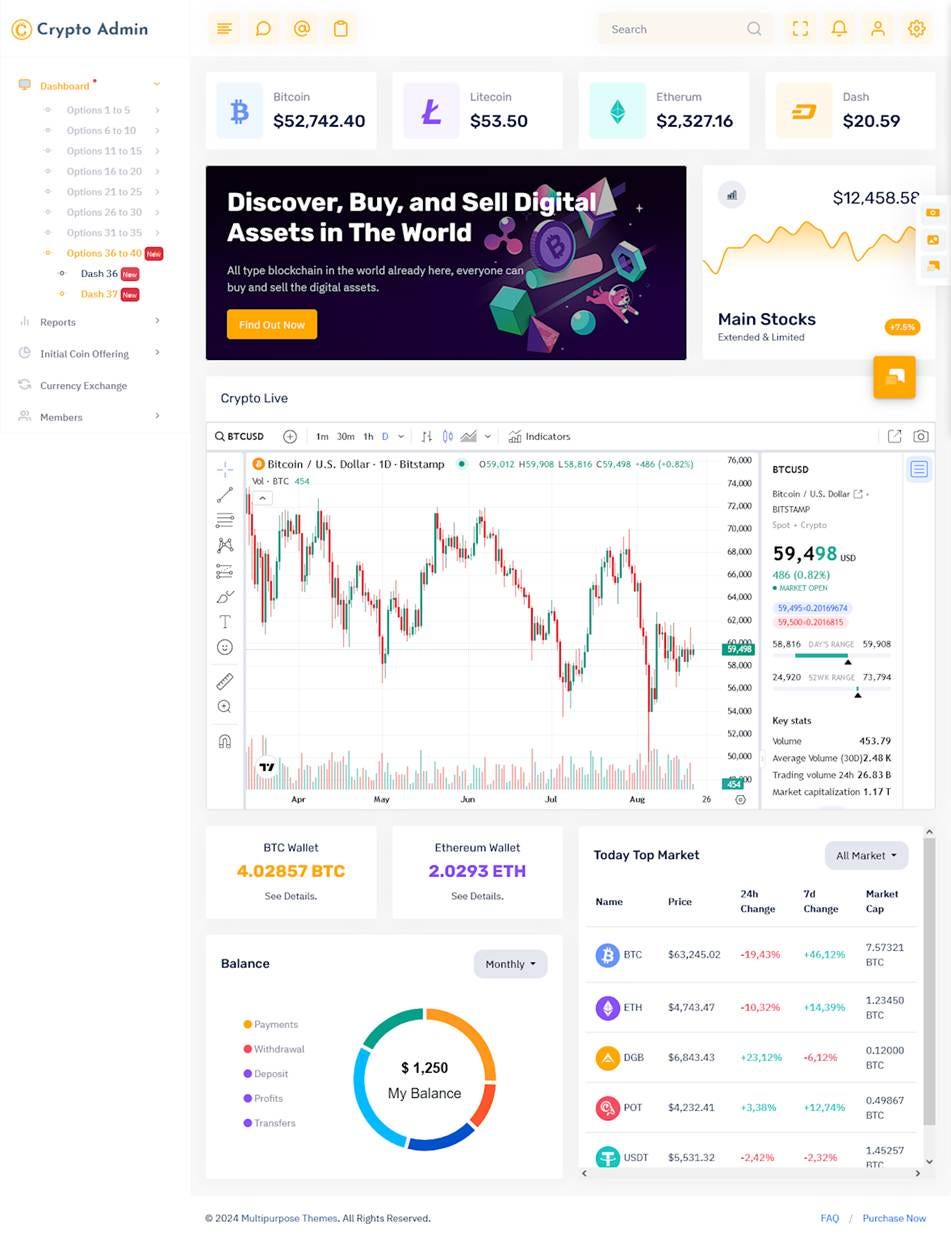

Crypto Admin dashboard displaying real-time cryptocurrency prices, live BTC/USD candlestick chart, portfolio balance, recent transactions, and market analytics.

Technical Infrastructure and Implementation

The technical foundation supporting AI-powered crypto trading relies on sophisticated infrastructure combining blockchain integration, machine learning pipelines, and real-time data processing capabilities.

Data Processing Architecture

Modern AI trading systems process enormous datasets from multiple sources simultaneously. These systems analyze over 400,000 data points per second across multiple exchanges, incorporating:

· On-chain metrics: Transaction volumes, wallet flows, and smart contract interactions

· Market data: Price movements, order book depth, and trading volumes across 50+ exchanges

· Sentiment feeds: Real-time social media analysis from Twitter, Reddit, and news sources

· Macroeconomic indicators: Interest rates, inflation data, and traditional market correlations

Machine Learning Model Architecture

The most successful AI trading systems employ ensemble approaches combining multiple machine learning techniques. Research demonstrates that ensemble neural networks outperform single-model approaches, with one study showing AI-driven strategies achieving 1640.32% returns compared to 304.77% for single ML models.

Key architectural components include:

Neural Network Ensembles: Combining feedforward networks, LSTM, and GRU architectures for comprehensive pattern recognition

Reinforcement Learning Agents: Continuously improving allocation strategies through simulated environment training

Real-time Adaptation: Models that retrain on new data to maintain accuracy across changing market regimes

Crypto trading dashboard showing live bitcoin chart, market data, wallet balances, and top market cryptocurrencies.

Integration Challenges and Solutions

Implementing AI trading systems in DeFi environments presents unique technical challenges:

Blockchain Integration: Systems must interact with multiple blockchain networks, each with different protocols and transaction speeds. Modern solutions use modular smart-contract adapters that automatically deploy, withdraw, and swap assets across protocols.

Latency Management: With cryptocurrency markets operating 24/7 across global time zones, systems require sub-millisecond execution capabilities. Advanced platforms achieve 50-millisecond trade execution while monitoring over 500 trading pairs simultaneously.

Security Considerations: AI systems require secure access to user funds through API keys and smart contract permissions while maintaining decentralized principles. Solutions include multi-signature wallets, secure relayers, and fail-safe mechanisms that pause activity when risk thresholds are breached.

Implications and Market Outlook

The convergence of AI and cryptocurrency trading is accelerating, with several trends shaping the future landscape:

Market Expansion

The AI crypto trading bot market, currently valued at $40.8 billion in 2024, is expected to grow at a 37.2% CAGR to reach $985.2 billion by 2034. This exponential growth reflects increasing institutional adoption and the maturation of AI trading technologies.

Technological Advancement

Future developments will likely include more sophisticated natural language processing capabilities, enhanced cross-chain interoperability, and improved integration with traditional financial markets. The development of quantum-resistant algorithms will also become crucial as quantum computing advances.

Regulatory Evolution

As AI systems handle larger volumes of cryptocurrency trading, regulatory frameworks will evolve to address algorithmic trading risks, market manipulation concerns, and systemic stability issues. This will likely lead to increased compliance requirements and standardization of AI trading practices.

The transformation of cryptocurrency trading through AI represents a fundamental shift in how digital assets are analyzed, traded, and managed. From sentiment analysis achieving 89.6% accuracy in price predictions to autonomous DeFi bots managing billions in assets, these technologies are creating new paradigms for market participation. As the ecosystem continues to mature, the integration of AI will likely become even more sophisticated, offering both unprecedented opportunities and new challenges for traders, regulators, and the broader financial system.

The future of cryptocurrency trading is increasingly automated, intelligent, and interconnected, promising more efficient markets while requiring careful consideration of risks and regulatory implications. As these technologies continue to evolve, they will likely play an increasingly central role in the global financial ecosystem.

Note: This is my own opinion and not the opinion of my employer, State Street, or any other organization. This is not a solicitation to buy or sell any cryptocurrency or stock. I use a Large Language Model (LLM) aided workflow. This allows me to test 5-10 ideas and curate the best 2-4 a week for you to read. We are always seeking feedback to enhance this process.

Additionally, if you would like updates more frequently, follow me on X:https://x.com/cryptowalk2000. In addition, feel free to send me corrections, new ideas for articles, or anything else you think I would like: cameronfen at gmail dot com.

Sources:

1. https://www.frontiersin.org/journals/artificial-intelligence/articles/10.3389/frai.2025.1519805/full

3. https://twitterapi.io/blog/leveraging-ai-for-crypto-trading

4. https://ecohumanism.co.uk/joe/ecohumanism/article/view/6729

5. https://thesai.org/Publications/ViewPaper?Volume=13&Issue=10&Code=IJACSA&SerialNo=105

6. https://arxiv.org/html/2508.15825v1

7. https://www.dwf-labs.com/news/the-impact-of-ai-on-crypto-trading-and-market-making

8. https://www.sciencedirect.com/science/article/pii/S0169207025000147

9. https://www.etd.ceu.edu/2023/zhumagaziyev_sh.pdf

10. https://www.ampcome.com/post/ai-agents-in-crypto-2025-guide

11. https://www.rapidinnovation.io/post/7-best-defi-trading-bots-in-2024-a-guide-for-entrepreneurs

12. https://www.antiersolutions.com/blogs/how-ai-powered-optimizers-are-solving-defis-biggest-challenge/

13. https://www.iaesirfinance.com/blog/defi-algorithmic-trading