Ethereum's Ethereum Virtual Machine (EVM) stands at the center of one of blockchain technology's most compelling narratives: how market leadership can paradoxically inhibit the very innovation that created success. While Ethereum remains the undisputed king of smart contract platforms with its robust ecosystem and unparalleled developer adoption, it faces mounting pressure from high-performance competitors like Solana. This challenge exemplifies Clayton Christensen's "innovator's dilemma"—where established market leaders struggle to embrace disruptive technologies that might cannibalize their existing advantages.

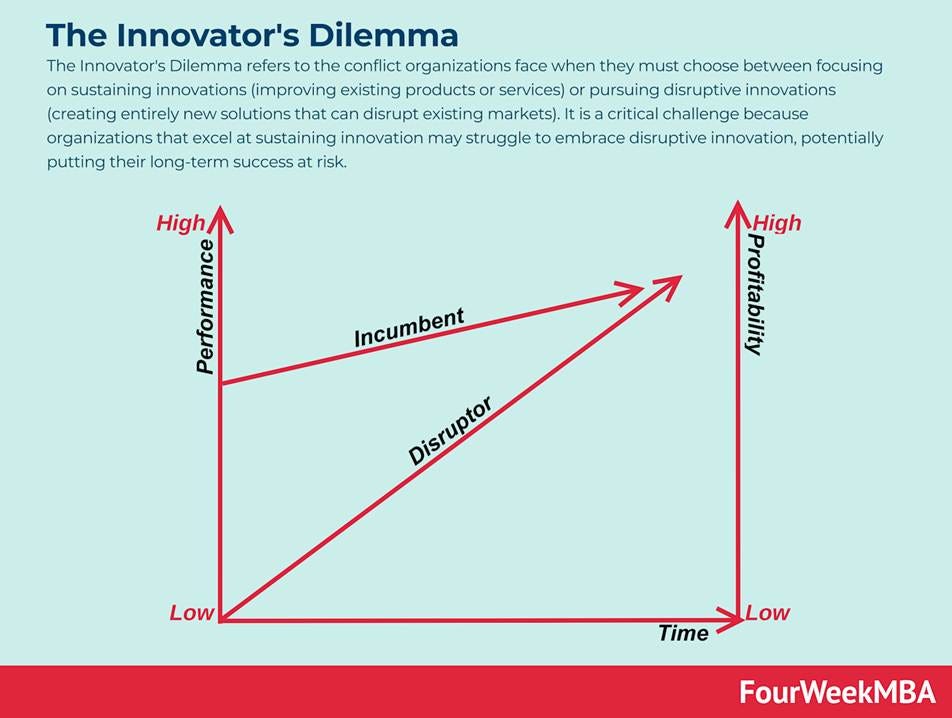

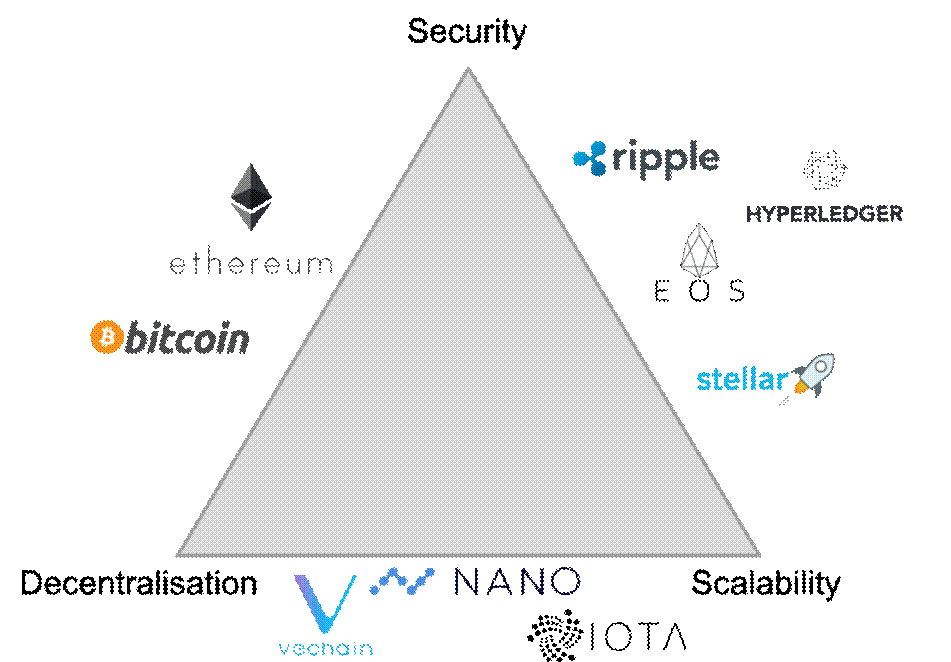

Diagram illustrating the Innovator's Dilemma, showing how incumbents and disruptors differ in innovation performance and profitability over time.

Understanding the Ethereum Virtual Machine

The Ethereum Virtual Machine serves as the computational engine that powers the world's most influential smart contract platform. Operating as a decentralized state machine across thousands of nodes globally, the EVM executes smart contracts with mathematical precision and unwavering consistency. This distributed architecture ensures that every node reaches identical conclusions about transaction outcomes, creating the trustless environment that makes decentralized applications possible.

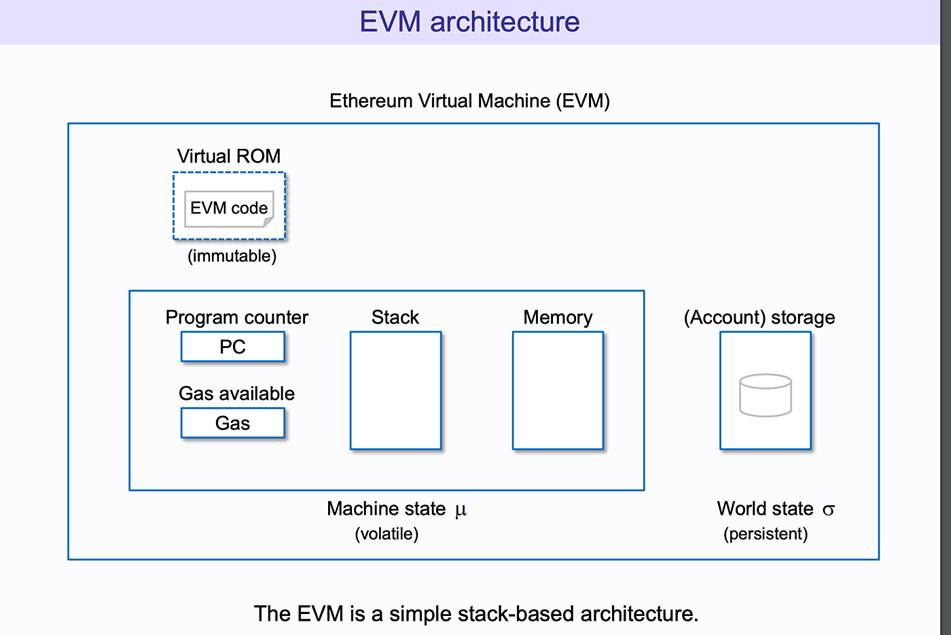

Ethereum virtual machine (EVM) architecture diagram showing key components like virtual ROM, machine state with program counter, stack, memory, gas, and persistent account storage.

At its core, the EVM employs a stack-based architecture with 256-bit word processing, optimized for cryptographic operations essential to blockchain functionality. The system manages three critical data types: temporary memory that clears after each transaction, persistent storage that maintains contract state across the blockchain, and immutable program code that defines smart contract behavior. Each computational operation consumes "gas," a mechanism that prevents infinite loops while creating economic incentives for efficient programming.

Ethereum's decentralized network architecture showcasing distributed validation nodes

The EVM's design philosophy prioritizes security and decentralization over raw performance. This architectural decision has proven prescient, as Ethereum has processed over $4 trillion in transaction volume without a single successful attack on the core protocol. However, this conservative approach limits the network to approximately 15-30 transactions per second on the mainnet, creating the scalability bottleneck that competitors like Solana have sought to exploit.

Solana's Revolutionary Approach

Solana represents a fundamental reimagining of blockchain architecture, prioritizing performance and user experience through innovative parallel processing capabilities. Unlike Ethereum's sequential transaction processing, Solana's Virtual Machine (SVM) leverages the Sealevel parallelization engine to execute thousands of smart contracts simultaneously. This parallel execution model enables Solana to theoretically process up to 65,000 transactions per second, with recent stress tests achieving over 107,000 TPS under optimal conditions.

Solana's parallel execution model enabling simultaneous transaction processing

The architectural differences between EVM and SVM extend far beyond raw throughput numbers. Solana employs a stateless execution model where smart contracts don't maintain persistent storage directly. Instead, they interact with a global account system that clearly defines data ownership and permissions. This design eliminates many of the state management complexities that can slow traditional blockchain networks, while its use of Rust and C programming languages provides memory safety and performance optimization.

Solana's Proof of History (PoH) consensus mechanism further distinguishes it from Ethereum's approach. PoH creates a cryptographic clock that sequences transactions efficiently, enabling validators to process transactions without extensive communication about timing. Combined with Proof of Stake validation, this system reduces confirmation times to approximately 400-600 milliseconds compared to Ethereum's 15-second block times.

The Performance Reality: Benchmarks and Trade-offs

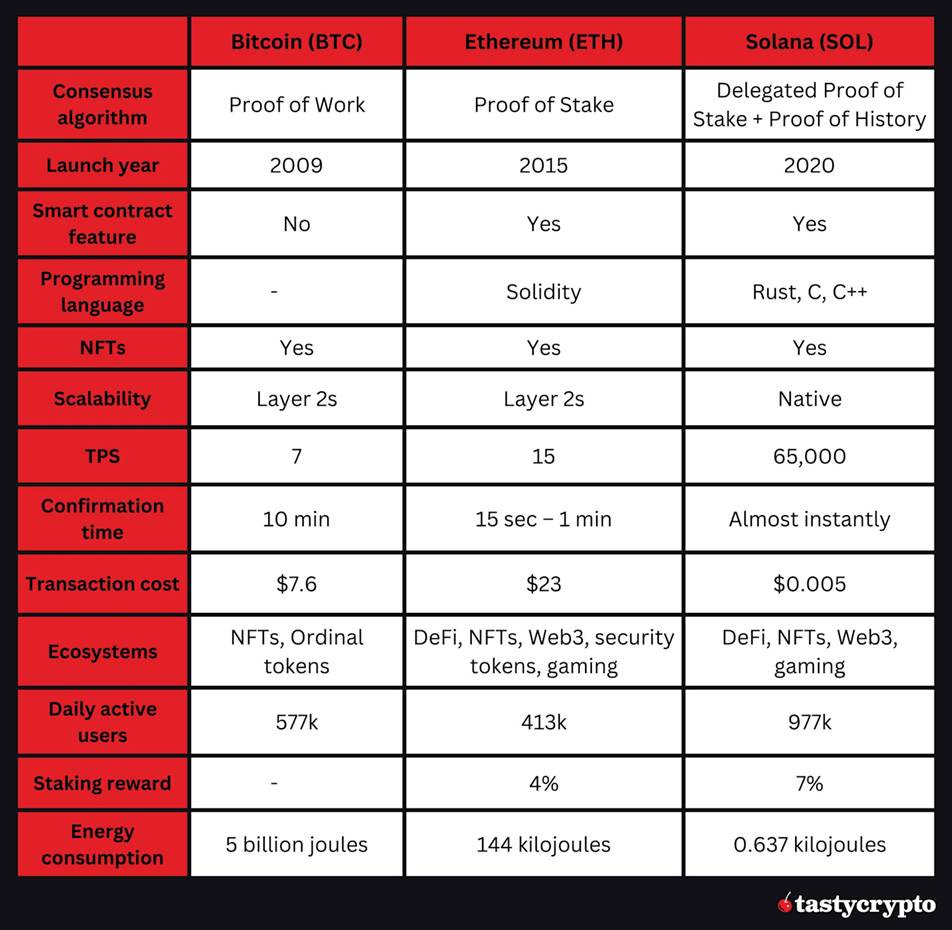

While marketing claims often highlight theoretical maximums, real-world performance tells a more nuanced story. Ethereum's mainnet processes approximately 11-15 TPS under normal conditions, with transaction fees varying dramatically based on network congestion. During peak usage periods, gas fees can surge to $50-100 per transaction, effectively pricing out many users and use cases.

Comparison of Bitcoin, Ethereum, and Solana blockchain features, performance metrics, and ecosystem attributes.

Solana's practical throughput presents a more complex picture than its theoretical capabilities suggest. Recent analysis reveals that while stress tests achieved 107,540 TPS, actual user transactions typically range between 1,000-3,700 TPS. Much of Solana's transaction volume consists of validator votes and system transactions rather than user-initiated activities. However, even this "real-world" performance significantly exceeds Ethereum's capabilities, with transaction fees consistently under $0.01.

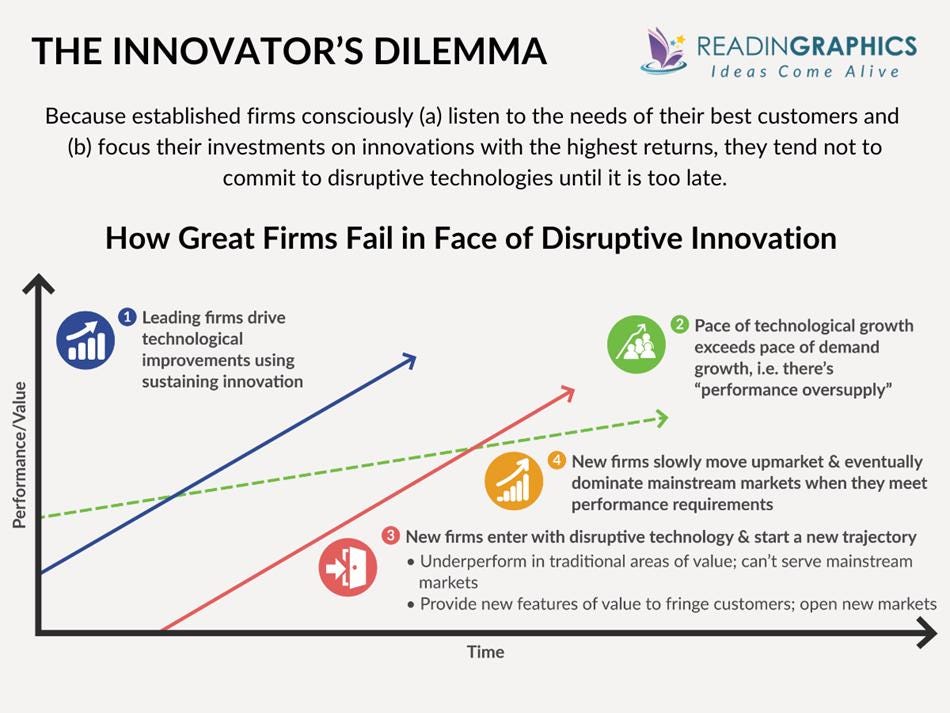

The blockchain trilemma—the challenge of optimizing security, decentralization, and scalability simultaneously—manifests differently in each network's design choices. Ethereum prioritizes security and decentralization, requiring extensive validation that limits scalability. Solana optimizes for scalability and speed, but this comes at the cost of requiring more powerful validator hardware, potentially limiting decentralization.

The blockchain trilemma diagram illustrating the trade-offs between security, decentralization, and scalability with various blockchain platforms positioned according to their strengths.

Ethereum's Layer 2 Evolution

Recognizing the limitations of its base layer, Ethereum has embraced a modular scaling approach through Layer 2 solutions. These systems process transactions off-chain before settling final states on the mainnet, dramatically reducing costs and increasing throughput. Leading Layer 2 networks like Arbitrum and Optimism now process 11-12 times more transactions than Ethereum's mainnet.

The introduction of EIP-4844 in March 2024 marked a significant milestone in this evolution, introducing "blob" transactions that reduce Layer 2 costs by up to 98% for some rollups. This upgrade enables Layer 2 networks to post transaction data more efficiently, with platforms like Optimism and Arbitrum now offering transaction fees below $0.10.

However, this modular approach introduces complexity that challenges user experience. Transactions often require bridging between layers, creating friction that Solana's monolithic architecture avoids. While Layer 2 solutions address Ethereum's scalability constraints, they fragment liquidity and create a more complex ecosystem for developers and users to navigate.

The Innovator's Dilemma in Action

Ethereum's position exemplifies the classic innovator's dilemma facing dominant technology platforms. The network's success stems from its early-mover advantage, extensive developer tooling, and battle-tested security model. With over $60 billion in total value locked across its ecosystem and the largest developer community in blockchain, Ethereum enjoys network effects that create significant switching costs for users and developers.

Illustration of the innovator's dilemma showing why leading firms fail to adopt disruptive technologies timely, illustrating the trajectory of sustaining innovation versus disruptive innovation over time.

This market position creates institutional resistance to fundamental architectural changes that might improve performance. Ethereum's roadmap emphasizes incremental improvements and Layer 2 scaling rather than the radical architectural shifts that enabled Solana's performance advantages. The network's stakeholders—from validators to application developers—have invested heavily in the existing EVM infrastructure, making disruptive changes economically and politically challenging.

Solana, as the disruptive innovator, entered the market with superior performance characteristics but initially served niche applications where speed mattered more than ecosystem maturity. Gaming applications, high-frequency trading platforms, and micropayment systems found Solana's architecture compelling despite its smaller ecosystem and less proven track record.

The innovator's dilemma suggests that Ethereum's rational focus on serving its existing high-value customers and maintaining network stability may inadvertently cede ground to competitors in performance-sensitive applications. While Ethereum optimizes for institutional use cases that value security and decentralization over speed, Solana captures market share in applications where performance is paramount.

Market Dynamics and User Adoption

Recent data reveals the complex competitive dynamics between these platforms. Solana consistently reports 10 times more daily active addresses than Ethereum mainnet, with transaction volumes often exceeding 80-100 times Ethereum's throughput. This activity surge reflects Solana's appeal for applications requiring frequent user interactions, particularly in gaming, NFT trading, and decentralized finance.

However, these metrics can be misleading when isolated from broader ecosystem considerations. Ethereum's Layer 2 networks collectively process nearly 30 million transactions daily, demonstrating that the entire Ethereum ecosystem remains competitive in aggregate throughput. The higher transaction costs on Ethereum also indicate higher economic value per transaction, suggesting different user behaviors and use cases across networks.

Developer adoption patterns reveal another dimension of the competition. Ethereum's Solidity programming language and extensive tooling ecosystem continue to attract the majority of new blockchain developers. Solana's requirement for Rust or C programming creates a higher barrier to entry, though its developer experience has improved significantly.

Technical Architecture Comparison

The fundamental architectural differences between EVM and SVM create distinct advantages and limitations for each platform. Ethereum's account model ties execution logic and storage together within smart contracts, creating a familiar programming environment but limiting optimization opportunities. Solana's separation of executable programs from data accounts enables greater flexibility but requires developers to explicitly manage state relationships.

Gas economics further distinguish these systems. Ethereum's global fee market means that popular applications can cause network-wide fee spikes, affecting all users regardless of their transaction types. Solana's localized fee markets prevent individual account congestion from impacting the broader network, though this advantage comes with increased complexity in fee prediction.

The execution environments themselves reflect different philosophical approaches to blockchain design. EVM's deliberate limitations prevent certain classes of operations that might compromise network security, while SVM's more permissive architecture enables higher performance at the potential cost of increased attack surfaces.

Future Trajectories and Strategic Implications

Ethereum's long-term scaling roadmap, known as "The Surge," envisions Layer 2 networks achieving 100,000+ TPS through advanced rollup technologies. However, the timeline for these improvements remains uncertain, potentially allowing Solana and other high-performance blockchains to establish stronger market positions in performance-sensitive applications.

The competitive landscape continues evolving as both ecosystems adapt to market demands. Ethereum's focus on modular scaling and security-first design appeals to institutional users and high-value applications, while Solana's integrated performance advantages attract consumer-focused applications and use cases requiring frequent interactions.

Neither approach represents a definitively superior strategy—instead, they reflect different trade-offs in the blockchain trilemma. Ethereum's deliberate optimization for security and decentralization may prove more valuable as blockchain technology matures and regulatory frameworks develop. Conversely, Solana's performance advantages may become increasingly important as blockchain applications scale to mainstream adoption levels.

The innovator's dilemma suggests that established platforms like Ethereum face inherent challenges in responding to architectural innovations that require fundamental changes to their core design. However, Ethereum's Layer 2 strategy represents a sophisticated response that preserves the base layer's security properties while enabling competitive performance through modular scaling.

As the blockchain ecosystem continues maturing, the success of each platform will likely depend not on achieving perfect solutions to the blockchain trilemma, but on how effectively they serve their chosen market segments and adapt to evolving user needs. The tension between innovation and stability that defines the innovator's dilemma will continue shaping how these foundational blockchain platforms evolve in response to competitive pressures and technological possibilities.

The ultimate resolution of this competition may not involve a single winner, but rather the emergence of a multi-chain ecosystem where different blockchain architectures serve distinct use cases based on their unique strengths and design philosophies.

Notes: This is my own opinion and not the opinion of my employer, State Street, or any other organization. This is not a solicitation to buy or sell any cryptocurrency or stock. I use a Large Language Model (LLM) aided workflow. This allows me to test 5-10 ideas and curate the best 2-4 a week for you to read. We are always seeking feedback to enhance this process.

Additionally, if you would like updates more frequently, follow me on X:https://x.com/cryptowalk2000. In addition, feel free to send me corrections, new ideas for articles, or anything else you think I would like: cameronfen at gmail dot com.

Sources:

3. https://builtin.com/articles/solana-vs-ethereum

4. https://www.nervos.org/knowledge-base/comparing_blockchain_virtual_machines

6. https://nu.fi/blog/what-are-the-differences-between-evm-and-svm

7. https://coincub.com/eth-vs-sol/

8. https://supra.com/academy/ethereum-vs-solana/

12. https://cryptoslate.com/solana-smashes-107000-tps-milestone-sparking-questions-about-real-world-use/

13. https://www.coinbase.com/learn/crypto-glossary/what-is-the-blockchain-trilemma

14. https://www.starknet.io/blog/layer-2-scaling-solutions/

15.

https://l2fees.info

16. https://www.gate.com/learn/articles/ethereum-and-the-innovators-dilemma/3123

17. https://www.brookings.edu/articles/the-innovators-dilemma-and-u-s-adoption-of-a-digital-dollar/

18. https://squads.so/blog/solana-svm-sealevel-virtual-machine

Image Sources:

1. https://fourweekmba.com/innovators-dilemma/

2. https://coinsbench.com/ethereum-virtual-machine-evm-bea6b4b887ca

3. https://www.tastycrypto.com/blog/bitcoin-vs-ethereum-vs-solana/

5. https://readingraphics.com/book-summary-the-innovators-dilemma/